islamic law of property distribution/Inheritance (Mirath)

1. Introduction to Islamic Law of Inheritance (Mirath)

Inheritance is one of the most important aspects of Islamic family life. It’s not just about money or property — it’s about fulfilling rights, maintaining justice, and ensuring harmony among family members after someone passes away. In Islam, the system of inheritance is called Mirath, and it’s guided directly by divine instruction. That’s what makes it unique. While many legal systems leave room for personal judgment or custom, Islamic inheritance law is based on verses from the Qur’an and the teachings of the Prophet Muhammad (peace be upon him).

In this introduction, we’ll explore what Mirath means, why it holds such a significant place in Islamic law, and how it benefits individuals, families, and society as a whole.

What is Mirath?

The Arabic word Mirath literally means “inheritance” or “legacy.” In Islamic law (Shariah), it refers to the distribution of a deceased person’s property among their rightful heirs. These rules are not arbitrary — they are derived from Allah’s commandments in the Qur’an, and detailed further in the Hadith.

Unlike some systems where you can write a will and leave everything to one person, Islamic inheritance law is fixed: certain people are entitled to specific shares. This protects the rights of vulnerable family members, especially women, orphans, and the elderly.

Why is Inheritance So Important in Islam?

Inheritance is mentioned in at least three long verses of the Qur’an (Surah An-Nisa: verses 11, 12, and 176). That’s more detail than almost any other legal issue in the Qur’an. Why? Because Allah knows the potential for conflict when it comes to wealth and property.

Family disputes, grudges, and even legal battles often arise after a person dies — especially when the distribution of their estate is unclear. Islam aims to prevent these conflicts by laying out a transparent and fair system.

Beyond that, the inheritance law reflects Islamic values:

Justice: Everyone gets what they are entitled to — no more, no less.

Responsibility: Especially toward dependents and those who may not have independent means.

Spiritual order: By following divine guidance, Muslims seek the pleasure of Allah in managing worldly affairs.

Who Needs to Understand Mirath?

Everyone. It doesn’t matter if you’re young, single, married, a parent, or even someone who thinks they don’t have much property — understanding inheritance is part of living as a responsible Muslim. Here’s why:

If you own anything, you need to know how it will be distributed after your death.

If you are a potential heir, you should understand your rights and responsibilities.

If you live in a non-Muslim country, you may need to write an Islamic will to ensure your property is distributed according to Shariah.

It’s also helpful for community leaders, lawyers, and Islamic scholars to educate others on this topic — because misinformation is common, and cultural practices often overshadow religious ones.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

A Brief Look at the Process

When a Muslim passes away, the property they leave behind (after paying off debts and funeral expenses) becomes the estate. This estate is then divided into:

Debts: Must be paid first — even before giving anything to the heirs.

Wasiyyah (Will): Up to one-third of the estate can be given to someone not already entitled to inherit (e.g., charity, a friend, or a distant relative).

Faraid (Fixed Shares): The rest is distributed among the heirs based on clear Islamic laws.

So before anyone starts dividing up land, jewelry, or bank accounts, it’s essential to take care of the first two steps. Many people skip these steps, leading to serious issues later on.

Cultural vs. Islamic Practices

One of the biggest problems in many Muslim societies is the confusion between culture and religion. For example:

Some families exclude daughters from inheritance, thinking it’s a tradition — even though it’s forbidden in Islam.

Others divide everything equally among all children — not realizing that Islam gives different shares based on gender and relation.

Some people think writing a will gives them the right to distribute their estate however they want — but Islamic wills come with limits.

These cultural habits are not only incorrect but can also be considered sins if they violate the rights of rightful heirs.

Benefits of Following Islamic Inheritance Law

When Islamic inheritance laws are properly followed, the benefits are immense:

Fairness: No one is cheated out of their rightful share.

Harmony: Families avoid unnecessary conflict.

Protection: Vulnerable members, like widows or orphaned children, are safeguarded.

Accountability: The deceased’s debts are paid, and their last wishes are respected (within Shariah).

Above all, it reflects obedience to Allah. It’s an act of worship to plan your estate and ensure your heirs follow Islamic guidelines.

Modern-Day Challenges

In today’s world, Muslims face a few unique challenges:

Living in non-Muslim countries: Secular laws may override Islamic ones unless you make a valid will.

Complex assets: Things like stocks, digital assets, or international properties require special planning.

Lack of awareness: Many Muslims don’t know the rules or delay writing wills until it’s too late.

Thankfully, many Islamic scholars, organizations, and legal services now help Muslims plan their estate according to Shariah — even in countries like the UK, USA, or Canada.

2. Key Principles and Sources Guiding Property Distribution in Islam

When it comes to property distribution, Islam doesn’t leave anything to guesswork. It lays out a clear, structured, and divinely guided system based on justice, compassion, and responsibility. These rules weren’t made by any human committee — they were revealed by Allah (SWT) and clarified by the Prophet Muhammad (peace be upon him). This section takes a closer look at the principles behind inheritance in Islam and the primary sources from which these laws are derived.

Divine Guidance, Not Human Invention

In many cultures, inheritance laws are influenced by politics, societal trends, or personal preferences. But in Islam, the laws of inheritance are rooted in divine wisdom. They aren’t meant to favor one person or group over another. Instead, they’re designed to reflect the responsibilities and financial roles that each person plays in a family and society.

So when we talk about “principles,” we’re really talking about how Allah designed a fair system that takes everyone’s needs into account — men, women, children, spouses, parents, and even distant relatives.

The Four Main Sources of Islamic Inheritance Law

Islamic law, including inheritance, is based on four main sources:

1. The Qur’an

The most detailed guidance on inheritance comes straight from the Qur’an. In Surah An-Nisa (Chapter 4), Allah outlines the shares of various heirs with remarkable precision. These verses form the core of Islamic inheritance law:

Verse 11: Talks about shares for children and parents.

Verse 12: Covers spouses and siblings.

Verse 176: Clarifies inheritance in the case of siblings when a person dies childless.

These verses are not just suggestions — they are legal rulings. Allah even warns us in the Qur’an not to change them or ignore them:

“These are the limits set by Allah. And whoever obeys Allah and His Messenger will be admitted to gardens… But whoever disobeys… will abide in Hell…”

(Qur’an 4:13-14)

2. The Sunnah (Hadith of the Prophet ﷺ)

The sayings and practices of the Prophet Muhammad (peace be upon him) provide further clarification and examples. For instance:

The Prophet said:

“Give the Faraid (fixed shares) to those who are entitled to receive them. Then whatever remains, should be given to the closest male relative.”

(Sahih al-Bukhari)

This Hadith supports the process of distributing fixed shares first, then giving the remainder (if any) to eligible residuary heirs (Asabah).

The Prophet also emphasized that a Muslim can only bequeath up to one-third of their wealth in a will, and even that should not cause harm to rightful heirs.

3. Ijma (Consensus of Scholars)

Over time, scholars have developed a consistent interpretation of Qur’anic inheritance laws. The consensus (Ijma) of early Islamic jurists — especially from the four major schools of thought (Hanafi, Maliki, Shafi’i, Hanbali) — helps Muslims apply these laws across different situations and time periods.

While the basic shares are fixed, Ijma plays a role in applying these rules to complex modern cases, like partial heirs, missing persons, adopted children, and digital assets.

4. Qiyas (Analogical Reasoning)

Sometimes, scholars face new situations not directly addressed in the Qur’an or Sunnah — like dealing with frozen bank accounts or cryptocurrency. In these cases, Qiyas (analogy) is used to extend existing rulings to new scenarios, based on the same principles of fairness and justice.

Core Principles Behind Islamic Inheritance Law

Now that we’ve looked at the sources, let’s dive into the key principles that make the Islamic system of inheritance unique and comprehensive.

1. Fixed Shares Are Mandatory

In Islam, certain family members are guaranteed a portion of the deceased’s wealth. These shares are non-negotiable. You can’t write a will that changes them or excludes someone.

This ensures:

Protection for weaker members of the family.

Avoidance of favoritism or manipulation.

Transparency and fairness in the process.

2. Gender-Based Distribution Reflects Responsibility

One of the most discussed features of Islamic inheritance law is that a male often receives double the share of a female in the same category (e.g., a son gets double what a daughter receives). While this may seem unfair at first glance, it’s actually rooted in financial obligations.

In Islam:

Men are required to provide for their families — wives, children, even parents in some cases.

Women are not obligated to spend their wealth on anyone, even if they inherit less.

This system doesn’t reflect value — it reflects responsibility.

3. Justice Over Emotion or Custom

Islamic law doesn’t allow personal feelings or cultural customs to override divine law. Even if someone had a closer emotional bond with a niece, for example, she can’t receive more than her fair share if others are entitled.

Also, the rule that non-Muslims do not inherit from Muslims, and vice versa, is based on preserving religious identity and community ties.

4. The Rights of the Deceased Come First

Before any distribution can happen, the deceased’s rights must be honored:

Funeral costs.

Payment of debts.

Execution of a valid will (up to one-third).

Only then can the remaining estate be divided among the heirs. This principle keeps the system just and ensures that the living don’t benefit while ignoring the obligations of the dead.

5. Preventing Disputes

Islamic inheritance law is designed to avoid family conflicts, which are sadly common after a person dies. By giving everyone a clear right, and by encouraging Muslims to write wills, the law reduces the chances of arguments, jealousy, or injustice.

Modern Applications of These Principles

Today, Islamic scholars and legal professionals continue to apply these principles to new challenges:

Writing legally valid Islamic wills in countries where secular law is dominant.

Estate planning tools that help calculate shares accurately.

Dispute resolution services based on Shariah principles.

There are even inheritance calculators online that help Muslims estimate the shares of heirs based on these exact laws. These tools show just how detailed and practical Islamic inheritance law really is.

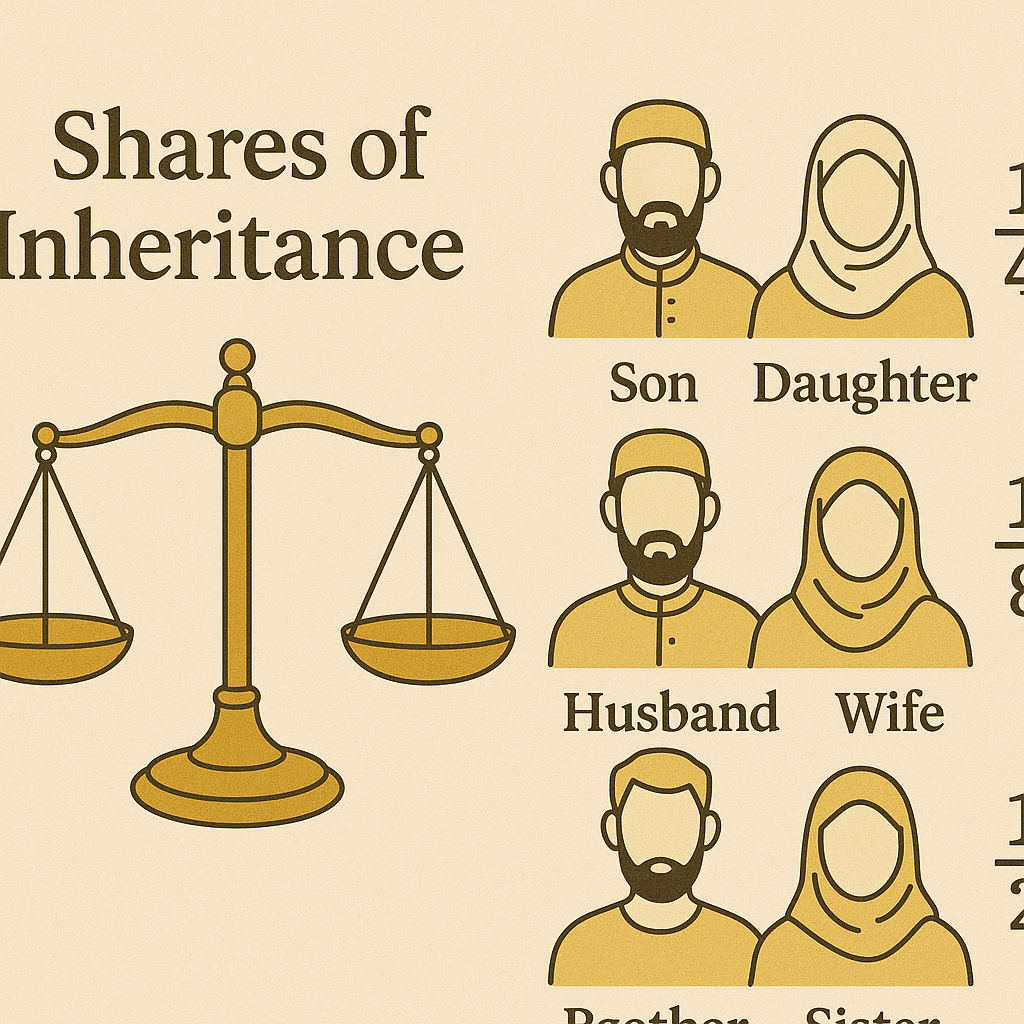

3. Fixed Shares: Who Inherits and How Much?

One of the most unique and detailed aspects of Islamic inheritance law is the concept of fixed shares, known as “Faraid”. These are the portions of an estate that Allah has specifically assigned to certain relatives — no one can increase or decrease them. This system ensures that each eligible family member receives what is rightfully theirs, without favoritism, personal bias, or manipulation.

In this section, we’ll break down:

Who the fixed-share heirs are.

What shares they are entitled to.

How gender, family structure, and relationships affect distribution.

The concept of residuary heirs (Asabah).

A practical example to bring it all together.

Who Are Fixed Share Heirs (Ashab al-Furud)?

The Quran explicitly names 12 categories of people who can inherit fixed shares. These individuals are prioritized and must receive their portion before the remainder (if any) is divided among others.

Here’s a list of primary fixed-share heirs:

Husband

Wife

Father

Mother

Daughter

Son’s daughter (granddaughter through son)

Full sister

Paternal sister

Maternal sister

Maternal brother

Grandmother (mother’s or father’s mother)

Grandfather (in some cases)

Each of these heirs may receive a specific portion depending on who else is alive at the time of the deceased’s death.

Common Shares According to the Qur’an

Let’s go over the most common fixed shares as outlined in the Qur’an:

1. Husband

1/2 of the estate if there are no children.

1/4 if the deceased has children.

2. Wife

1/4 if there are no children.

1/8 if there are children.

📖 “In what your wives leave, your share is a half if they have no child; but if they leave a child, you get a fourth…”

(Qur’an 4:12)

3. Father

Always gets at least 1/6.

If there are no sons, he may also receive the remaining estate as a residuary.

4. Mother

1/3 if the deceased leaves no children and no siblings.

1/6 if there are children or multiple siblings.

5. Daughter

One daughter alone: gets 1/2 the estate.

Two or more daughters: together receive 2/3 of the estate.

With sons: daughters receive half the share of sons.

6. Maternal Siblings

One sibling: receives 1/6.

Two or more: share 1/3 equally.

When There Are Multiple Heirs

Here’s where things get interesting — and sometimes complicated. When there are multiple heirs, the fixed shares have to be calculated carefully. You can’t just divide the estate equally; you must apply the Qur’anic shares in the correct order.

That’s why scholars and tools like Islamic inheritance calculators are often used to work out complex situations. The goal is to ensure no heir is deprived and that no one receives more than they’re entitled to.

Residuary Heirs (Asabah)

Once all the fixed shares are distributed, if anything is left over, it goes to the residuary heirs, known as Asabah. These are usually:

Sons

Brothers

Paternal uncles

Male descendants

Residuary heirs don’t have fixed shares. They inherit what remains after all fixed shares and obligations have been fulfilled.

If the deceased has a son, for example, he will receive the remainder of the estate after all fixed shares are paid — and he’ll also ensure other siblings receive their appropriate shares.

Male Gets Double the Female: Why?

A commonly asked question is: Why do sons get twice as much as daughters?

The answer lies in Islamic financial responsibility, not in value or status:

Men are financially obligated to support their families, wives, and children.

Women are not required to spend from their inheritance. It remains solely theirs.

So the extra share given to men is really a burden of responsibility, not a privilege. Islam balances this with the woman’s right to own, save, and spend her wealth without obligation.

Who Is Excluded from Inheritance?

Certain individuals cannot inherit under Islamic law:

Murderers: A person who intentionally kills the deceased is barred from inheritance.

Non-Muslims: Generally, a non-Muslim cannot inherit from a Muslim, and vice versa.

Illegitimate children: According to most scholars, they do not inherit from their biological father unless legally recognized.

However, a person can give them something in a will (Wasiyyah) — up to one-third of the estate.

The Role of the Islamic Will

While fixed shares can’t be altered, the Islamic will allows a person to:

Give up to 1/3 of their estate to non-heirs (e.g., charity, adopted children, or friends).

Leave instructions for the distribution of personal items or care of dependents.

Clarify funeral and burial wishes.

This part of the estate is flexible — but it must not harm the rights of fixed-share heirs.

A Simple Example

Let’s say a man dies leaving:

A wife

A mother

One son

One daughter

Step 1: Pay debts and funeral expenses.

Step 2: Execute any valid will (up to 1/3).

Step 3: Distribute the estate.

Now, assuming a clean estate worth $90,000:

Wife gets 1/8 = $11,250

Mother gets 1/6 = $15,000

Remaining estate = $63,750

This remainder is shared by the son and daughter in a 2:1 ratio:

Son gets $42,500

Daughter gets $21,250

Everything is accounted for, and all fixed shares are fulfilled. This structured approach helps prevent disputes and ensures divine justice.

The Beauty in the Details

What’s beautiful about this system is that it’s designed to work across every generation and society. Whether you live in a village or a modern city, the principles stay the same:

Protect the weak.

Reward responsibility.

Ensure fairness through fixed, divinely ordained shares.

Even though the calculations can get tricky, the spirit of the law is simple: give everyone their due, and don’t play favorites.

4. Rules Regarding Will (Wasiyyah) and Debts in Islamic Inheritance

Islam doesn’t just care about who gets what after a person dies — it also lays out a clear process for how things must be handled before any inheritance is distributed. This includes paying off debts, honoring the will (Wasiyyah), and covering funeral expenses. These steps are crucial because they reflect a person’s responsibilities, not just to their family, but to Allah, society, and justice.

In this section, we’ll explore:

The importance and limits of the Islamic will (Wasiyyah).

How debts are prioritized before distribution.

The correct order of inheritance execution.

Common misconceptions.

Real-life applications and advice.

A. What Is a Wasiyyah (Islamic Will)?

A Wasiyyah is a legal and spiritual instruction left by a Muslim that details what should happen to a part of their estate after death. But unlike a Western-style will, which can divide the entire estate however the person chooses, a Wasiyyah in Islam is limited in scope.

1. The One-Third Rule

A Muslim is only allowed to bequeath up to one-third of their estate through a Wasiyyah — and that too only to non-heirs.

❝ The Prophet ﷺ said: “It is better for you to leave your heirs wealthy than to leave them dependent and begging from others. You may bequeath up to one-third, and even one-third is much.” ❞

(Sahih al-Bukhari, Sahih Muslim)

So, if you leave behind $90,000, the maximum amount you can distribute through a Wasiyyah is $30,000, and even that is ideally recommended to be less.

2. Who Can Benefit From a Wasiyyah?

Islam allows you to give your Wasiyyah to:

The poor and needy.

Charities and Islamic causes.

Adopted children.

Close friends or neighbors.

Non-Muslim relatives.

Any individual who is not already a legal heir.

💡 Important Note: You cannot leave Wasiyyah for someone who is already a Qur’anic heir — like your son, daughter, or spouse — unless all other heirs agree after your death.

3. Writing a Valid Wasiyyah

To be valid under Islamic law:

It must be written or verbally declared while the person is of sound mind.

It should be witnessed by two reliable individuals.

It should clearly state the beneficiaries, amounts, and purpose.

It should not contradict any Islamic rulings or harm rightful heirs.

A written Wasiyyah is strongly encouraged to prevent family disputes and ensure your final wishes are carried out properly.

B. Settling Debts Before Inheritance

In Islam, debts are considered sacred obligations. A person’s soul can remain “suspended” or delayed from complete peace until their debts are repaid.

❝ The soul of the believer is held hostage by his debt until it is paid off. ❞

(Sunan Ibn Majah)

So before any property is divided, all debts must be cleared, even if it means using the entire estate.

1. Types of Debts

Debts can be:

Financial debts to people (loans, unpaid wages, etc.).

Spiritual debts like unpaid Zakat, missed fasts or Hajj (if someone had the means and missed it).

Legal penalties or compensation (e.g., for damage caused to others).

These must be paid from the estate as a top priority — before heirs receive anything.

2. What If the Estate Can’t Cover the Debts?

If the estate is too small, the heirs are not obligated to pay the debts — but they can choose to do so voluntarily as a good deed. If they don’t, the creditors will have to forgive or seek repayment from other means.

That’s why Islam encourages people to live debt-free and not delay repayment during their lifetime.

C. The Correct Order of Distribution

Here’s the exact sequence of what should happen when a Muslim passes away:

Funeral Expenses: Shrouding, washing, burial, etc.

Outstanding Debts: All financial and religious debts.

Wasiyyah (up to 1/3): Executed only for non-heirs.

Inheritance Shares (Faraid): The rest is divided according to Qur’anic guidelines.

This order must be followed strictly. You can’t skip ahead to divide the estate among the kids if the debts haven’t been paid or the Wasiyyah hasn’t been handled.

D. Common Misconceptions About Wasiyyah and Debts

Let’s clear up a few common misunderstandings:

❌ “I can leave my whole estate to whoever I want.”

Not in Islam. Only one-third can be allocated freely. The rest is already spoken for by Allah.

❌ “If I don’t write a will, my family will figure it out.”

Without a Wasiyyah, your non-heir dependents (like an adopted child) or charity plans could be left with nothing. A will is essential.

❌ “Debts can be delayed or forgiven after I’m gone.”

Islam teaches us to clear debts during life, and they must be paid before anyone inherits.

E. Modern Implications: Legal and Practical Advice

In countries where Islamic law is not the default, like the U.S., UK, or many Western nations, your estate could be divided in ways that contradict Shariah — unless you’ve taken steps to secure your Islamic wishes legally.

Here are some tips:

Write an Islamic Will that complies with both local law and Shariah.

Include a clause saying the estate should be distributed according to Islamic law.

Name an executor who understands Islamic inheritance (often a trusted family member or a local scholar).

If needed, use Islamic legal services that help Muslims in non-Muslim countries set this up correctly.

F. Leaving a Legacy of Justice

At the end of the day, Wasiyyah and debt repayment aren’t just legal technicalities — they’re part of your legacy, your final act of justice, and your obedience to Allah. They reflect the type of life you lived, and how seriously you took your responsibilities.

A well-prepared Muslim plans for the Hereafter just as carefully as they planned for retirement or investments. That’s why the Prophet ﷺ emphasized writing your will and staying debt-free as part of a good life and a peaceful death. one may also explore here

5. Common Challenges and Misconceptions in Property Distribution under Islamic Law

Even though Islamic inheritance law (Mirath) is divinely ordained, clear in its foundation, and incredibly detailed — it’s not uncommon for Muslims today to face confusion, misapplication, or disputes when it comes to actually distributing wealth after death. Why? Because of a combination of cultural traditions, lack of knowledge, and sometimes, intentional neglect of Islamic rules in favor of personal preferences.

In this section, we’ll explore:

The most common challenges in applying Islamic inheritance.

Cultural practices that contradict Shariah.

Misconceptions about gender and fairness.

The impact of not planning ahead.

How to navigate disputes and promote justice in families.

A. Cultural Practices vs. Shariah: When Tradition Takes Over

In many communities, cultural customs are followed instead of Shariah law — especially in matters of inheritance. While some traditions may be harmless, many directly violate the commands of Allah.

❌ Example 1: “Only sons inherit property.”

In some cultures, especially in South Asia and parts of the Middle East, it’s common for daughters to be excluded from inheritance entirely — either because of social pressure or because they’re told, “You got your share at marriage.”

This directly contradicts the Qur’an, which says:

❝ For men is a share of what the parents and close relatives leave, and for women is a share of what the parents and close relatives leave, be it little or much — an obligatory share. ❞

(Surah An-Nisa 4:7)

Denying daughters, sisters, or mothers their rightful share is a major sin.

❌ Example 2: “Let’s divide it equally — that’s more fair.”

Some families try to give equal shares to sons and daughters thinking it’s more “just” — but this is changing divine law. Islam already defines fairness, and adjusting shares outside of Allah’s decree is forbidden unless all heirs agree after the death and waiver their right — and even that is discouraged.

B. Misconceptions About Gender and Fairness

One of the most misunderstood aspects of Islamic inheritance law is the difference in shares between male and female heirs.

💬 Misconception: “Islam treats women unfairly in inheritance.”

Reality: In many situations, women inherit equal or even more than men — it depends on the relationship and family structure.

For example:

A mother receives 1/6, and so does the father — in certain cases.

A wife receives 1/4 or 1/8, while the husband receives 1/2 or 1/4.

A sister can inherit more than a brother if she is the only surviving relative.

Islam’s system is not about preference but about responsibility. Since men are required to financially maintain women (in marriage, parenting, and society), their larger share reflects that burden — not privilege.

C. Legal and Bureaucratic Obstacles

Another challenge in applying Islamic inheritance is dealing with modern legal systems that don’t automatically recognize Shariah rulings. This is especially true in:

Western countries (e.g., U.S., Canada, UK).

Secular legal systems (where court laws may conflict with religious law).

Non-codified Islamic countries (where culture overrides Islamic law).

⚠️ Problem: If a Muslim dies without a will, the state may divide the estate according to civil law, not Islamic law.

That’s why it’s critical to:

Write an Islamic will, even in Muslim-majority countries.

Register it with appropriate authorities if possible.

Clearly appoint an executor who understands and respects Shariah.

D. Delaying Distribution of the Estate

Sometimes families delay dividing the estate for years or even decades after a person dies. This causes financial injustice and can even lead to:

Disputes between siblings or relatives.

Loss or devaluation of property.

Entire generations being deprived of their rightful share.

Islam teaches that the estate should be distributed as soon as possible after debts and Wasiyyah are cleared. Delays open the door to fitnah (conflict), especially when property appreciates or heirs pass away themselves, creating even more complexity.

E. Not Including Women in Inheritance Discussions

Often, women are left out of the conversation altogether. They may not even know they’re entitled to a share or feel pressured to “gift it” to their brothers.

But:

Guilt-tripping a woman into giving up her Islamic share is haram.

A forced or manipulated “gift” is not valid under Islamic law.

Allah has set these shares to honor her rights — and it’s a test for the family to uphold them.

F. Conflict Among Heirs: How to Avoid or Resolve

Sometimes, no matter how clear the rules are, disagreements happen. Money can bring out emotions, past grudges, or confusion.

To avoid or resolve disputes:

Involve a scholar or mediator familiar with Islamic inheritance.

Use inheritance calculators and expert advisors to show accurate shares.

Have a written record of debts, assets, and will instructions.

Encourage heirs to make decisions based on taqwa and fear of Allah.

Remember, the Prophet ﷺ said:

❝ Indeed, injustice will be darkness on the Day of Resurrection. ❞

(Sahih Muslim)

Cheating a sibling or hiding assets may go unnoticed here — but not in the Hereafter.

G. Emotional vs. Legal Decisions

Sometimes families make emotional decisions like:

Giving the house to the youngest son because “he stayed with the parents.”

Favoring the child who was “closer” to the parent.

While these feelings may be valid, the Islamic law of inheritance doesn’t work on emotion — it works on divine command.

You can still honor, reward, or gift someone during your lifetime — but once death occurs, the wealth no longer belongs to you — it belongs to the heirs, as assigned by Allah.

H. Practical Advice for Every Muslim

Educate your family: Make sure your children, spouse, and siblings understand Islamic inheritance.

Plan ahead: Write your Islamic will while you’re healthy and of sound mind.

Record your debts: Keep a clear list and make it accessible.

Be transparent about your assets: Don’t leave your family guessing.

Make du’a: Ask Allah for barakah and peace in your family after you’re gone.

Conclusion: Inheritance as a Spiritual Legacy

Islamic inheritance law is not just a legal system — it’s a reflection of faith, justice, and trust in Allah’s wisdom. When families follow these laws, they protect their loved ones from injustice, resentment, and long-term conflict.

On the other hand, ignoring or altering Allah’s inheritance law — even with good intentions — is considered a major sin and a form of oppression.

❝ These are the limits set by Allah, and whoever transgresses the limits of Allah has certainly wronged himself. ❞

(Surah At-Talaq 65:1)

By upholding this system, you’re not just distributing money — you’re fulfilling a divine command, preserving rights, and leaving behind a legacy of fairness and peace.